Please check our Frequently Asked Questions below. If you don’t find the answer you’re looking for, just call a representative at (800) 334-8609. International callers should dial (336) 607-2000, option 1.

You must have the latest version of Adobe Acrobat reader installed on your computer to successfully view and print our downloadable forms that may be referenced as links within our FAQs. Click on the Get Adobe Reader link to download a free copy of Adobe Acrobat Reader or visit the Adobe Web site at www.adobe.com. previous page

Our AutoDraft option automatically drafts your monthly or quarterly student loan payment from your checking or savings account on the date you specify. AutoDraft is available to borrowers with all loan types and is processed electronically through the Federal Reserve National Clearinghouse.

AutoDraft can save you time and money. Using AutoDraft eliminates the need to purchase stamps, mail your payments, or take time out of your busy day to call and make payments over the telephone. AutoDraft is an efficient way to make your student loan payment, and as long as you maintain sufficient funds in your account, you do not have to worry about late fees. AutoDraft transactions will appear each month as a debit on your bank statement.

You choose the day of the month (from the 1st to the 28th) that your payment will be debited. You also can choose the debit amount and the frequency (monthly or quarterly) that you want the debit to occur. NOTE: You cannot request a payment amount that is lower than the specified minimum amounts for your loan.

Signing up for AutoDraft is easy. You can enroll online by going to the login screen, and then selecting AutoDraft from the left-hand navigational bar. You also can sign up for AutoDraft by calling (800) 334-8609 to enroll on the phone or to request an AutoDraft application through our Interactive Voice Response system. You can also download an Autodraft Application from our Web site and mail it in.

It normally takes 15 days to set up AutoDraft. Please continue to make payments until you receive written notification from us stating that the account has been successfully set up on AutoDraft.

Any Changes to your current AutoDraft set-up will require a minimum of three business days prior to the draft date.

You should mail a written request along with legal documentation to Campus Partners, P.O. Box 2901,Winston-Salem, NC 27102-2901. A copy of your marriage license, divorce/separation decree, court order, social security card or naturalization card are considered legal documentation.

Yes, although your school may have updated your address and telephone number, it is your responsibility to contact Campus Partners to update your address and telephone number on our system. You may update your address and telephone number on our Web site. Once you have logged into the secure site, click the "Update My Profile" button, and you will be directed to your demographic information.

If the borrower or the co-borrower is deceased, a call should be placed to (800) 334-8609 to speak with a Borrower Service Representative. Federal regulations require proof of death by an original or certified copy of the death certificate. If a certified copy of the death certificate is unavailable, please contact our office.

Unless your school is listed below, you should contact them to request special payment arrangements. Your lender may allow Campus Partners to set your account up on "special billing."

"Special billing" is an agreement made between you and your school. This allows you to be billed a different amount for a specified period of time. The special billing payment amount is typically lower than the actual repayment amount.

Borrowers who received their loans from any of the following schools should only contact Campus Partners for this service. Please call (800) 334-8609.

If you can’t make your payments, you may be eligible for hardship deferment, unemployment deferment or forbearance. Call Campus Partners at (800) 334-8609 to see if you are eligible for one of these options

Forbearance allows a break from making payments, or grants a reduced payment amount. Interest continues to accrue during any period of forbearance, and you can opt to pay interest during this time. Forbearance is considered upon written request. The maximum forbearance time allowed over the life of the loan is 3 years, renewable at 12-month intervals.

Effective July 1, 1993, if your annual Title IV loan repayment obligation equals or exceeds 20% of your gross income or if your lending institution determines you qualify for other reasons, you may submit a written request for forbearance. You must complete an Application for Forbearance and submit this form to the school where you received the loan(s) or to Campus Partners. You will need to provide supporting documentation for a forbearance request.

You are required to continue making payments on your loan(s) until notification is sent stating that a forbearance has been processed on your account.

If you elect to pay interest during the forbearance period, you will receive a monthly interest bill. If you choose to pay the accrued interest at the end of the forbearance period, you will receive an interest bill approximately 20 days prior to the forbearance end date. This bill is due the day after the forbearance ending date.

You can get a forbearance application by calling Campus Partners at (800) 334-8609, or by downloading the Application for Forbearance form from this site.

If you are working full time and earn no more than the Federal Minimum Wage or an amount equal to 10% of the poverty line for a family of two, you may qualify for the economic hardship deferment.

The economic hardship deferment allows for a period of time where no payment is necessary and interest does not accrue. This deferment is renewable at 6-month intervals. You receive an added 6-month grace period at the end of each deferment period. During this grace period, no payment is necessary and interest does not accrue. You are returned to your normal billing cycle once the grace period ends. The maximum amount of economic hardship time allowed over the life of the loan is 3 years.

If you meet one of the following conditions and wish to apply for a deferment, contact your lender or Campus Partners to see if you qualify for an economic hardship deferment. You may qualify:

If you feel that you qualify for the economic hardship deferment, you must complete the Application for Hardship Deferment form and submit this form to the school where you received the loan(s) or to Campus Partners.

If you are seeking or unable to find full-time employment, you may qualify for the unemployment deferment. This is a period of time when no payment is required, and interest does not accrue.

To qualify for the unemployment deferment, you must:

Unemployment deferments are processed in six-month increments with a three-year limit. You will receive a six-month post-deferment grace period at the end of each deferment period. Once the six-month post deferment grace period ends, your loan will be placed back into repayment.

Call Campus Partners at (800) 334-8609, or download a form from our Web site.

Lenders may, at their option, declare a loan to be in default if:

Late fees can be assessed the day after the scheduled payment due date. Each institution determines when late fees are assessed.

Your loan has been placed in collections because of your current or historical delinquency. Loans are placed in collections in accordance with federal regulations and in accordance with the lending institution’s instructions. The lending institution also may assign a defaulted loan to the Department of Education for collection.

Acceleration means that the lending institution or the Department of Education has demanded immediate repayment of the entire unpaid balance of the loan, including principal, interest, late charges, collection costs and any other fees/costs that may be due. Borrowers with an accelerated loan lose their right to receive cancellation benefits for services performed after the date the lending institution or the Department accelerates the loan.

If you have a defaulted loan, you are ineligible for any further federal student financial assistance as authorized under the Higher Education Act of 1965 until you make satisfactory repayment arrangements with their lending institution or the Department of Education. The lending institution or the Department of Education always discloses defaulted student loans to credit bureau organizations.

NSLDS, or National Student Loan Data Systems, is the U.S. Department of Education’s central database for student aid. It receives data from schools, agencies that guaranty loans, the Direct Loan program, the Pell Grant program, and other Department of Education programs. NSLDS provides a centralized, integrated view of Title IV loans and Pell Grants that are tracked through their entire cycle from aid approval through closure.

NSLDS is a repository of information and cannot change the data that it receives. If you suspect that the status of your student loan is incorrect, please contact Campus Partners. We report to NSLDS monthly, and can make the appropriate changes during the next submittal.

The Federal Perkins Loan Rehabilitation program allows defaulted Perkins borrowers to regain many important benefits of the promissory note, which are lost if their loan defaults. After the loan has been rehabilitated, you regain eligibility for Title IV student financial assistance (i.e. may receive Federal student loans) and other benefits. If you are paying your defaulted loan through a collection agency, you also are eligible for the rehabilitation program.

Please click here for additional information.

Below are the requirements for the rehabilitation program.

Below are some of the benefits of the rehabilitation program.

According to federal regulations, the reporting requirements are as follows:

Campus Partners sends past due letters to you, reminding you to make a payment and informing you that the loan can be reported negatively to the credit bureau. Your lender may also choose to notify you if your loan has been reported to the credit bureau. This contact is sent in addition to the past due letters we send.

Campus Partners reports to the three major credit bureaus:

Trans Union Corporation

5600 77 Center Drive, Suite 350

Charlotte, NC 28217

Equifax Information Services

PO Box 74023

Atlanta, GA 30374-0243

Experian

295 Jimmy Doolittle Road

Salt Lake City, UT 84116

The above addresses are of corporate offices and are not the same as your local credit bureau. If you wish to file a dispute or have a complaint, you will need to contact your local credit bureau (look in your local phone book).

Campus Partners cannot remove information from a borrower’s credit file unless it was reported in error. Below are some examples of errors for which Campus Partners would send an update to change your credit file.

Below are situations in which Campus Partners would not send an update to change your credit file.

Campus Partners can send the updated information to the credit bureaus in as little as one day. However, it normally takes 60 days for the change to show on your credit report. We have no control over how long it takes for credit bureaus to update their records.

Loan cancellation is the reduction of loan principal in exchange for providing service in an eligible field. You are not responsible for repaying the portion of the loan that is cancelled or forgiven.

Please refer to the Terms and Conditions of your promissory note. There is also additional information for certain loan types on the primary page of the Information Center.

If you think that you qualify for total cancellation or partial cancellation of your loan, you may download a cancellation form from our Web site or call our office at (800) 334-8609 to request a form. If you usually mail payments to your school, click here: (Request for Cancellation for School Payments) to download a form. If you usually send payments directly to Campus Partners, use this form: (Request for Cancellation for Campus Partners Payments) .

Applying for a cancellation is a two-step process because a loan cancellation cannot be granted before you have completed your specified length of service.

The Campus Partners Web site provides help for borrowers filling out cancellation forms. Just go to " Cancellation Form Instructions ." If you do not have access to the Internet, you can get instructions by calling Campus Partners at (800) 334-8609 and speaking to a representative.

Campus Partners can send the updated information to the credit bureaus in as little as one day. However, it normally takes 60 days for the change to show on your credit report. We have no control over how long it takes for credit bureaus to update their records.

The total percentage cancelled on a loan depends on the type and length of service that is being provided. To get the total percentage amount and the percentage rate, borrowers should refer to their promissory note or call Campus Partners at (800) 334-8609.

You can download from our forms page or call us at (800) 334-8609. If you usually mail payments to your school, click here to download a form. If you usually send payments to Campus Partners, use this form.

Transcripts cannot be accepted as proof of enrollment. A completed deferment form or an enrollment verification letter signed by a representative from your school’s registrar’s office must be submitted.

It is your responsibility to ensure that forms are submitted on time.

It normally takes 3-5 business days to process a deferment once it is received.

You will receive notification from Campus Partners explaining whether the deferment was processed, denied or returned for additional information.

NSC is the National Student Clearinghouse, a non-profit association that maintains an electronic registry of records which provides accurate verification of student enrollments. This information is available to colleges and universities, students and alumni, lending institutions, employers, and other organizations. Schools affiliated with the Clearinghouse submit their students’ enrollment records several times each year, which updates the Clearinghouse’s databases.

Although Campus Partners receives an electronic file from NSC each week, you are responsible for verifying that your enrollment information is correct on our system. You should check with the school where you are enrolled, the Clearinghouse, or contact our office to ensure that we have received your enrollment information.

No. Borrowers are required to continue to make payments on their loan(s) until they receive verification of their deferred status.

Deferments should be submitted at the beginning of each quarter or semester.

All forms should be mailed to:

Campus Partners

P.O. Box 2901

Winston-Salem, NC 27102-2901

Borrowers also can fax deferment forms to Campus Partners for processing. Forms should be sent to the attention of "Forms Department" and faxed to (336) 607-2093.

If you do not have your billing statement, please mail your payment to:

Campus Partners

PO Box 2901

Winston-Salem, NC 27102-2901

Be sure to write your account number on your check.

We accept payments over the phone. There is a $15.00 fee for this service. The fee will be waived if you sign up for AutoDraft (Automatic Direct Draft). Please see FAQs about AutoDraft for more information.

We are happy to offer you the option of making a payment through our Web site. When you click on the "Pay my loan" link on our home page or on the left-hand navigational bar of this page, you will be prompted to supply your banking information and payment amount. After confirming this information and hitting the submit button, your payment is routed to us electronically. No checks to write, no stamps to buy, and no envelopes to mail! Best of all, we waive the $15.00 processing fee we normally charge for pay-by-phone payments when you pay via the Web. Although you must have a User ID and password to use this option, registration only takes a few minutes and you’re ready to go. to go.

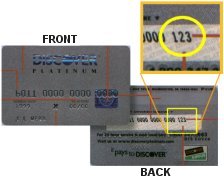

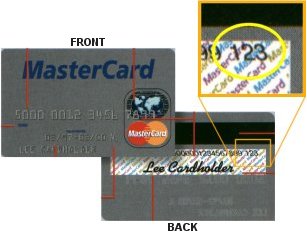

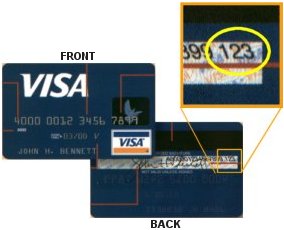

Yes, Campus Partners accepts credit card payments.*

*Some schools or lenders do not allow payment by credit card. Your available options will be displayed in the Payment Method window.

Telephone or online payments will post to your loan(s) on the following business day, but will be dated as of your telephone or online payment date. The payment will not be reflected on mycampusloan.com immediately.

Online payments requested on weekends or holidays will be processed during the next business day, and will be posted the day after processing. The payment date will reflect the date of your online payment request.

There is no penalty for paying off your NDSL Perkins, Health Professional, or Nursing Student Loan(s) early. If you have an institutional loans, please refer to your promissory note, check with your lending institution, or contact Campus Partners to find out if there is a penalty for paying your loan off early.

The payoff amount printed on your billing statement is the payoff amount as of the date the statement was printed and is for informational use only. Because interest accrues on your account daily, you cannot use the payoff amount printed on your billing statement to pay off your loan(s). In order to obtain an accurate payoff amount, please use one of the following methods:

Interest accrues daily using the Daily Simple Interest accrual formula.

One day of interest is calculated as follows:

Principal Balance X Interest Rate

365 (number of days in year)

E-Bill (electronic billing) is a new billing option for registered users of mycampusloan.com. Once you are enrolled in E-Bill, you will receive an e-mail notification when your statement is available for viewing on mycampusloan.com. The e-mail will be sent in place of your regular paper billing statement. After you receive the e-mail notification that your bill is available, you may log on to the web site and view your statement information. Then you have a choice to pay your bill by creating an E-Pay transaction (on-line electronic payment) or you may mail a payment to our office.

If you are unable to enroll in E-Bill and do not feel the above reasons apply to you, please contact our office at 1-800-334-8609 to speak with an account representative.

Once you have completed the enrollment request on www.mycampusloan.com, you will receive a consent e-mail. The consent e-mail will verify that you want the E-Bill service and that you have the technology required to receive e-mails from our office. If you wish to participate in E-Bill, you do not need to respond to this e-mail. If you decide to cancel your participation in our E-Bill service, you should respond to the e-mail address provided, and your loan(s) will be returned to paper billing statement status.

E-mail notification of upcoming payment due dates are sent to the e-mail address that you provided during the registration process, which is approximately 19 to 20 days prior to the payment due date. When you receive the e-mail notification, simply login to our Web site, and click on the "View Statement" button. After you review your statement, you can submit an E-Pay transaction, call our office to make a payment over the telephone for a small service fee, or mail a check to our office.

No. Once you are enrolled in E-Bill, you will only receive e-mails informing you of your next payment due date.

No. If your payment is past due, we will continue to mail paper past due statements to the address we have on file for you

No, Campus Partners cannot duplicate the e-mail notification process. You simply log on to our Web site, and click on the "View Statement" button again if you accidentally delete your statement.

When you receive the e-mail notification that you have a payment becoming due, you must log on to our Web site www.mycampusloan.com. Once you are logged in to the secure site, you will see the "View Statement" button on the View My Accounts screen. Click on the "View Statement" button, and you will be linked to your most recent statement. You can pay your bill via E-Pay or you may mail a check to our office.

Your on-line statement is available each time you log in to our Web site. Your statement is updated to reflect the most recent status of your loan. There may be times such as weekends or holidays that your information is not updated until we refresh our files. We strive to provide you with the most up-to-date loan information as possible.

In order to qualify for loan cancellation, you must meet the specific eligibility requirements for that cancellation. The following cancellations may be available to you. Select the specific cancellation type and review the eligibility requirements.

National Defense Loan Program - Funds received before July 1, 1972

National Direct Loan Program - Funds received on or after July 1, 1972 to June 30, 1987

Federal Perkins Loan Program - Funds received on or after July 1, 1987

If you are a National Defense Loan fund borrower, you may cancel up to 50% of your outstanding balance for full-time teaching in a public or other non-profit elementary or secondary school. You may also qualify for this same type of cancellation for full-time teaching in an institution of higher learning or an overseas Department of Defense elementary or secondary school. The cancellation rate is 10% of the original principal loan amount plus interest that accrued during the year eligible for this service.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Regardless of when you received your loan, you may cancel up to 100% of your National Defense/National Direct/Federal Perkins loan for full-time teaching in a public or other non-profit elementary or secondary school determined by the state agency to be an eligible school. To be considered a "low-income school", the school where your taught must be in a district that qualified for federal funds in the year for which you are filing for cancellation. Also, more than 30 percent of the school's enrollment must be made up of children from low-income families. To determine if the school where you taught is listed as an eligible low-income school, click here.

The cancellation rate for eligible National Defense borrowers is 15% of the original principal loan amount plus interest that accrued during the year eligible for this service. National Direct and Federal Perkins borrowers are eligible for a 15% cancellation for the first and second year of service, 20% for the third and fourth year, and 30% for the fifth year.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Beginning with the 1967-68 academic year, if you are a National Defense Loan borrower, you may cancel up to 100% of your debt for teaching handicapped children in a public or other nonprofit elementary or secondary school. Your teaching must be full time and a majority of the students that you teach must be handicapped children. The cancellation rate is 15% of the original principal loan amount plus interest that accrued during the year eligible for this service.

Handicapped children are defined as: Children ages 3 - 21 inclusive who require special education and related services because they are mentally retarded, hard of hearing, deaf, speech and language impaired, visually handicapped, seriously emotionally disturbed orthopedically impaired, specific learning disabled or otherwise health impaired.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

If you received a Federal Perkins or National Direct loan made after July 23, 1992, you may be eligible for up to 100% of your loan debt cancelled for full-time teaching in mathematics, science, foreign languages, or bilingual education. You may also qualify for full-time teaching in a designated shortage area. Each year each state education agency determines any subject shortage areas in the elementary and secondary schools within the state. To determine if your subject matter area has been designated as a shortage area, click here.

Note: If you teach full time in mathematics, science, foreign language, or bilingual education, you qualify for loan cancellation even if the state has not designated one of these subject areas as a shortage area. The majority of classes taught must be in that field of expertise.

If you received a Federal Perkins, National Direct or National Defense loan that was made prior to July 23, 1992 are also eligible for this same type cancellation for teaching service performed on or after October 7, 1998. The cancellation rate is 15% of the original principal loan amount plus interest for the first and second year of service, 20% for the third and fourth year, and 30% for the fifth year of eligible service.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

If you received a Federal Perkins or National Direct loan made after July 23, 1992, you may be eligible for up to 100% of your loan debt cancelled for full-time employment as a nurse or medical technician. To qualify for a nurse cancellation, you must be a licensed practical nurse, a registered nurse, or other individual who is licensed by the appropriate State agency to provide nursing services.

A medical technician is defined as, "an allied health professional (working in fields such as therapy, dental hygiene, medial technology, or nutrition) who is certified, registered, or licensed by the appropriate state agency in the state in which he or she provides health care services. An allied health professional is someone who assists, facilitates, or complements the work of physicians and other specialists in the health care system."

Borrowers of Federal Perkins, National Direct or National Defense loan funds made prior to July 23, 1992 are also eligible for this same type cancellation for teaching service performed on or after October 7, 1998. The cancellation rate is 15% of the original principal loan amount plus interest for the first and second year of service, 20% for the third and fourth year, and 30% for the fifth year of eligible service.

To receive cancellation benefits as a nurse or medical technician, you must be employed for 12 consecutive months. When filing for this type of cancellation, there may be additional information you will need to provide. Click here to download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form \ Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Borrowers of Federal Perkins or National Direct loan funds made after July 23, 1992 may be eligible for up to 100% loan cancellation if working as a full-time special education teacher of infants, toddlers (from birth to age 2), who need early intervention services for specific reasons, or children or youth, from ages 3 through 21 who require special education and related services due to disabilities. To qualify, you must be licensed, certified, or registered by the appropriate state education agency for that area in which you are providing related special education services, and the services you provide are part of the educational curriculum for handicapped children:

Borrowers of Federal Perkins, National Direct or National Defense loan funds made prior to July 23, 1992 are also eligible for this same type cancellation for teaching service performed on or after October 7, 1998. The cancellation rate is 15% of the original principal loan amount plus interest for the first and second year of service, 20% for the third and fourth year, and 30% for the fifth year of eligible service.

Regardless of when you received your loan funds, you may cancel up to 100% of your National Defense/National Direct/Federal Perkins loans for service that includes August 14, 2008, or begins on or after that date as a full-time special education teacher of infants, toddlers, children or youth with disabilities in an educational service agency.

When filing for this type cancellation, be sure and include a complete job description, a description of your students and the percentage of students that are disabled.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

If you received a Federal Perkins, National Direct or National Defense loan, you may be eligible for up to 100% of your loan debt cancelled for service as a full-time firefighter employed at a local, state, or Federal fire department or fire district. Cancellation may be granted for eligible service that includes August 14, 2008, or begins after that date. To receive cancellation benefits as a firefighter, you must be employed full time for 12 consecutive months.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Regardless of when you received your loan funds, you may be able to cancel up to 100% of your National Defense/National Direct/Federal Perkins loans if you are a librarian with a master's degree in library science. You must be employed in an elementary or secondary school that qualifies for Title I funding, or in a library that serves a geographic area that includes one or more Title I schools.

Cancellation may be granted for eligible service that includes August 14, 2008, or begins after that date. To receive cancellation benefits as a librarian, you must be employed full time for 12 consecutive months. Also, when applying for this type of cancellation, there may be additional information you will need to provide. Click here to download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

If you receive a Federal Perkins, National Direct or National Defense loan, you may be eligible to cancel up to 100% of your loan debt for service as a full-time speech/language pathologist with a master's degree, if you are working exclusively with Title I-eligible schools.

Cancellation may be granted for eligible service that includes August 14, 2008, or begins after that date. To receive cancellation benefits as a speech-language pathologist, you must be employed full time for 12 consecutive months. Also, when applying for this type of cancellation, there may be additional information you will need to provide. Click here to download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

If your Federal Perkins or National Direct loan was made after July 23, 1992, you may be eligible for up to 100% of your loan funds cancelled for service as a full-time qualified professional provider of early intervention services in a public or other nonprofit program under public supervision by the lead agency as authorized in section 632(4) of the Individuals with Disabilities Education Act. The services you provide must be designed to meet a handicapped infant's or toddler's * developmental need in one or more of the following areas:

If your Federal Perkins, National Direct or National Defense loan was made prior to July 23, 1992, you are also eligible for this same type cancellation for teaching service performed on or after October 7, 1998. The cancellation rate is 15% of the original principal loan amount plus interest for the first and second year of service, 20% for the third and fourth year, and 30% for the fifth year of eligible service.

To receive cancellation benefits as a provider of early intervention services, you must be employed full time for 12 consecutive months. Also, when applying for this type of cancellation, you may need to provide additional information. Click here to download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Borrowers of Federal Perkins or National Direct loan funds made after July 23, 1992 may be eligible for up to 100% of their loan funds cancelled for service as a full-time employee in a public or other nonprofit child or family service agency who is providing, or supervising the provision of services to both high risk children * who are from low-income communities and the families of such children.

To receive cancellation for this type of service, you must be employed at a child or family services agency and provide services only to high-risk children from low-income communities. You may also be providing services to adults, but these adults must be members of the families of the children for whom services are being provided. The services provided to these adults must be secondary to the services provided to the high-risk children. The Department of Education has determined that elementary or secondary schools, or hospitals are not eligible employing agencies.

Borrowers of Federal Perkins, National Direct or National Defense loan funds made prior to July 23, 1992 are also eligible for this same type cancellation for teaching service performed on or after October 7, 1998. The cancellation rate is 15% of the original principal loan amount plus interest for the first and second year of service, 20% for the third and fourth year, and 30% for the fifth year of eligible service.

To receive this type of cancellation benefit, you must be employed full time for 12 consecutive months. Also, when applying for this type of cancellation, you may need to provide additional information. Click hereto download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

* High risk children are individuals under the age of 21 who are low-income or at risk of abuse, neglect, have been abused or neglected, have serious emotional, mental or behavioral disturbances, reside in placements outside their homes, or are involved in the juvenile justice system.

If your Federal Perkins or National Direct loan was made on or after November 29, 1990, you may be eligible to have up to 100% of your loan cancelled for full-time service as a law enforcement officer or corrections officer for an eligible employing agency.

If your Federal Perkins, National Direct or National Defense loan was made prior to November 29, 1990, you are also eligible for this same type cancellation for service on or after October 7, 1998. The cancellation rate is 15% of the original principal loan amount plus interest for the first and second year of service, 20% for the third and fourth year, and 30% for the fifth year of eligible service.

A local, state, or federal agency is an eligible employing agency if it is publicly funded and its activities pertain to crime prevention, control, reduction or to the enforcement of the criminal law. Such activities include, but are not limited to, police efforts to prevent, control or reduce crime or to apprehend criminals; activities of courts and related agencies having criminal jurisdiction; activities of corrections, probation, or parole authorities; and problems relating to the prevention, control, or reduction of juvenile delinquency or narcotic addiction.

Agencies that are primarily responsible for enforcement of civil, regulatory, or administrative laws are ineligible. If your primary responsibilities are supportive, such as typing, filing, accounting, office procedures, purchasing stock control, food service, transportation, or building, equipment, or grounds and maintenance, you are ineligible for this type of cancellation.

Your position must be considered essential to the agency's primary mission and you must be a full-time employee of an eligible agency, and a sworn law enforcement or corrections officer. You may also be eligible for this type of cancellation if your principal responsibilities are unique to the criminal justice system as well as essential in the performance of the agency's mission. Prosecuting attorneys whose primary responsibilities are to prosecute criminal cases on behalf of public law enforcement agencies are eligible for cancellation benefits.

Federal Perkins, National Direct, or National Defense loan borrowers may be eligible to have up to 100% of their loan funds cancelled for service as a full-time attorney employed as a public defender in a Federal public defender organization or community defender organizations established in accordance with federal regulations. To determine if your organization meets the appropriate requirements, click here. Next, click on Federal Public and Community Defender Directory. Loan cancellation may be granted for eligible service that includes August 14, 2008, or begins after that date.

To receive this type of cancellation benefit, you must be employed full time for 12 consecutive months. Also, when applying for this type of cancellation, you may need to provide additional information. Click here to download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Federal Perkins or National Direct loan borrowers may be eligible for up to 100% of their loan funds cancelled if they are employed as a full-time staff member in the educational part of a Head Start program. Borrowers of National Defense loans are also eligible to cancel 100% of their loan funds for this service if the service was performed on or after October 7, 1998.

"Head Start" is a preschool program carried out under the Head Start Act (Subchapter B, Chapter 8 of Title VI of Pub. L. 97-35, the Budget Reconciliation Act of 1981, as amended; formerly authorized under section 222(a)(1) of the Economic Opportunity Act of 1964). (42 U.S.C. 2809(a)(1)).

The cancellation rate is 15% of the original principal loan amount plus interest on the unpaid balance for each year of qualifying service. A "full-time staff member" is defined as a person regularly employed in a full-time capacity to carry out the educational part of a Head Start program. When applying for this type of cancellation, you may need to provide additional information. Click here to download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

If you are a Federal Perkins loan borrower, you may be eligible for up to 70% of your loan funds cancelled for service as a volunteer under the Peace Corps Act or the Domestic Volunteer Service Act of 1973 (ACTION programs). Borrowers of National Direct and National Defense loans are also eligible to cancel 70% of their loan amount if the service was performed on or after October 7, 1998.

The cancellation rate is 15% of the original principal loan amount plus interest for the first and second year of qualifying service, and 20% for the third and fourth year. The period of service in all cases must equal a 12-month period. (Your form must be certified by an authorized official of the Peace Corps or Americorps*VISTA program.)

Americorps volunteers do not qualify for this loan cancellation unless their volunteer service is with Americorps*VISTA. As an Americorps*VISTA volunteer, you may only qualify for this cancellation type if you do not elect to receive a national service education award for your volunteer service. In this case, you must provide appropriate documentation showing that you declined the Americorps national service education award.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Borrowers with a Defense loan made after April 13, 1970 for service starting after June 30, 1970 may be eligible to cancel up to 50% of these funds for full-time service in the US Army, Navy, Air Force, Marine Corps, or Coast Guard. The cancellation rate is 12% for each year of qualifying service. Service for less than a complete year does not qualify for military cancellation.

Federal Perkins and Direct borrowers may be eligible to cancel up to 50% of their loan for service performed in an area of hostilities that qualifies for special pay under section 310 of title 37 of the United States Code. The cancellation rate is 12 ½ % for each year of qualifying service that ended before August 14, 2008. Borrowers whose service includes August 14, 2008 or begins after that date may qualify to have up to 100% of their loan cancelled for this same service. The cancellation rate in this case is 15% of the original principal loan amount for the first and second year of service, 20% for the third and fourth year, and 30% for the fifth year of eligible service.

Service for less than a complete year does not qualify for military cancellation. Eligible branches of service include the US Army, Navy, Air Force, Marine Corps, or Coast Guard. For an up-to-date list of areas that qualify for special pay because of duty subject to hostile fire or imminent danger (areas of hostilities), visit: http://www.defenselink.mil/comptroller/fmr/07a/07aarch/07A10m.pdf .

To apply for this cancellation type, you must complete a cancellation request form and submit this form to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form instead.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Regardless of when you received your loan funds, you may be eligible to have up to 100% of your National Defense/National Direct/Federal Perkins loans canceled if you are employed as a full-time faculty member at a Tribal college or university. A full-time faculty member is defined as an educator or tenured individual who is employed by a Tribal college or university to teach, research, or perform administrative functions. The Department of Education provides a list of eligible Tribal colleges and universities. To determine if your school qualifies, click here.

Cancellation may be granted for eligible service that includes August 14, 2008, or begins after that date. To receive cancellation benefits as a faculty member at a Tribal college or university, you must be employed full time for 12 consecutive months.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

If you received Federal Perkins, National Direct, or National Defense loan funds, you may be eligible for up to 100% of your loan funds cancelled for service as a full-time staff member of a pre-kindergarten or childcare program that is licensed or regulated by the State.

Loan cancellation may be granted for eligible service that includes August 14, 2008, or begins after that date. To receive cancellation benefits as a full-time staff member of a pre-kindergarten or childcare program, you must be employed full time for 12 consecutive months. Also, when applying for this type of cancellation, you may need to provide additional information. Click here to download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Regardless of when you received your loan funds, you may eligible to have up to 100% of their National Defense/National Direct/Federal Perkins loans canceled if you are a teacher in a designated low-income elementary or secondary school and are employed by an educational service agency. An educational service agency is a regional public multi-service agency authorized by State law to develop, manage, and provide services or programs to local educational agencies. The educational service agency must also be included in the directory of low-income schools. To determine if your educational service agency is listed, click here.

Cancellation may be granted for eligible service that includes August 14, 2008, or begins after that date. To receive cancellation benefits as a teacher in a low-income educational service agency, you must be employed full time for 12 consecutive months.

To apply for a cancellation, download the required form(s) listed under Cancellation Types and Eligibility Requirements. Complete the form in detail and be sure to include any required authorization or documentation. Send the form to Campus Partners for processing. We will process your request promptly. You will receive notification explaining whether your cancellation request was applied, rejected, or returned to you for additional information.

Please mail your forms and other required information to:

Campus PartnersThis section provides in-depth information concerning cancellation options for borrowers who have received Nurse Faculty loan funds. This loan fund was created by the Department of Health and Human Services, Health Resources and Services Administration to increase the number of qualified nurse faculty for the nation's nursing programs.

You are eligible to have up to 85% of your loan cancelled (forgiven) for employment as a full-time faculty member in a school of nursing. To receive this loan cancellation, you must be employed full time as nurse faculty at a school of nursing for a complete year, as defined by the employing school of nursing as 12 consecutive months. During a period of cancellation, principal and interest will be cancelled. The cancellation rate for eligible borrowers is 20% for the first, second, and third year of employment and 25% for the fourth year of employment. These percentages are calculated based on the amount of the unpaid loan balance as of the first day of employment. To receive these cancellation benefits over the course of four years, your employment must be consecutive.

Two forms are required for each year of eligible employment. A postponement request should be submitted 30 days before your original nine (9) month grace period expires and annually thereafter. You must also complete and submit a request for cancellation for that same year's service upon completion of each year of employment as faculty at a school of nursing. To apply for this cancellation type, you must complete and submit this form to the school where you received the loan(s) or to its billing agent, Campus Partners.

Please note:

You may be ineligible for further cancellation benefits under the following circumstances:

Paid leave such as vacation or sick leave is not considered a break in service. Once you receive the maximum portion (up to 85%) of the principal amount of the loan and interest, the remaining amount (15% or more depending upon years of employment) of the unpaid balance is repayable at a 3% interest rate over the remainder of your repayment period. The maximum repayment period is 10 years.

* The prevailing market rate is determined by the Treasury Department and is published quarterly in the Federal Register.

• Back to Top of Section •If your Federal Perkins or National Direct loan was made after July 23, 1992, you may be eligible for up to 100% of your loan funds cancelled for service as a full-time qualified professional provider of early intervention services in a public or other nonprofit program under public supervision by the lead agency as authorized in section 632(4) of the Individuals with Disabilities Education Act. The services you provide must be designed to meet a handicapped infant's or toddler's * developmental need in one or more of the following areas:

If your Federal Perkins, National Direct or National Defense loan was made prior to July 23, 1992, you are also eligible for this same type cancellation for teaching service performed on or after October 7, 1998. The cancellation rate is 15% of the original principal loan amount plus interest for the first and second year of service, 20% for the third and fourth year, and 30% for the fifth year of eligible service.

To receive cancellation benefits as a provider of early intervention services, you must be employed full time for 12 consecutive months. Also, when applying for this type of cancellation, you may need to provide additional information. Click here to download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form instead.

* Infants or toddlers include children from birth to age 2.

Borrowers of Federal Perkins or National Direct loan funds made after July 23, 1992 may be eligible for up to 100% of their loan funds cancelled for service as a full-time employee in a public or other nonprofit child or family service agency who is providing, or supervising the provision of services to both high risk children * who are from low-income communities and the families of such children.

To receive cancellation for this type of service, you must be employed at a child or family services agency and provide services only to high-risk children from low-income communities. You may also be providing services to adults, but these adults must be members of the families of the children for whom services are being provided. The services provided to these adults must be secondary to the services provided to the high-risk children. The Department of Education has determined that elementary or secondary schools, or hospitals are not eligible employing agencies.

Borrowers of Federal Perkins, National Direct or National Defense loan funds made prior to July 23, 1992 are also eligible for this same type cancellation for teaching service performed on or after October 7, 1998. The cancellation rate is 15% of the original principal loan amount plus interest for the first and second year of service, 20% for the third and fourth year, and 30% for the fifth year of eligible service.

To receive this type of cancellation benefit, you must be employed full time for 12 consecutive months. Also, when applying for this type of cancellation, you may need to provide additional information. Click here to download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

* High risk children are individuals under the age of 21 who are low-income or at risk of abuse, neglect, have been abused or neglected, have serious emotional, mental or behavioral disturbances, reside in placements outside their homes, or are involved in the juvenile justice system.

If your Federal Perkins or National Direct loan was made on or after November 29, 1990, you may be eligible to have up to 100% of your loan cancelled for full-time service as a law enforcement officer or corrections officer for an eligible employing agency.

If your Federal Perkins, National Direct or National Defense loan was made prior to November 29, 1990, you are also eligible for this same type cancellation for service on or after October 7, 1998. The cancellation rate is 15% of the original principal loan amount plus interest for the first and second year of service, 20% for the third and fourth year, and 30% for the fifth year of eligible service.

A local, state, or federal agency is an eligible employing agency if it is publicly funded and its activities pertain to crime prevention, control, reduction or to the enforcement of the criminal law. Such activities include, but are not limited to, police efforts to prevent, control or reduce crime or to apprehend criminals; activities of courts and related agencies having criminal jurisdiction; activities of corrections, probation, or parole authorities; and problems relating to the prevention, control, or reduction of juvenile delinquency or narcotic addiction.

Agencies that are primarily responsible for enforcement of civil, regulatory, or administrative laws are ineligible. If your primary responsibilities are supportive, such as typing, filing, accounting, office procedures, purchasing stock control, food service, transportation, or building, equipment, or grounds and maintenance, you are ineligible for this type of cancellation.

Your position must be considered essential to the agency's primary mission and you must be a full-time employee of an eligible agency, and a sworn law enforcement or corrections officer. You may also be eligible for this type of cancellation if your principal responsibilities are unique to the criminal justice system as well as essential in the performance of the agency's mission. Prosecuting attorneys whose primary responsibilities are to prosecute criminal cases on behalf of public law enforcement agencies are eligible for cancellation benefits.

Federal Perkins, National Direct, or National Defense loan borrowers may be eligible to have up to 100% of their loan funds cancelled for service as a full-time attorney employed as a public defender in a Federal public defender organization or community defender organizations established in accordance with federal regulations. To determine if your organization meets the appropriate requirements, click here. Next, click on Federal Public and Community Defender Directory. Loan cancellation may be granted for eligible service that includes August 14, 2008, or begins after that date.

To receive this type of cancellation benefit, you must be employed full time for 12 consecutive months. Also, when applying for this type of cancellation, you may need to provide additional information. Click here to download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Federal Perkins or National Direct loan borrowers may be eligible for up to 100% of their loan funds cancelled if they are employed as a full-time staff member in the educational part of a Head Start program. Borrowers of National Defense loans are also eligible to cancel 100% of their loan funds for this service if the service was performed on or after October 7, 1998.

"Head Start" is a preschool program carried out under the Head Start Act (Subchapter B, Chapter 8 of Title VI of Pub. L. 97-35, the Budget Reconciliation Act of 1981, as amended; formerly authorized under section 222(a)(1) of the Economic Opportunity Act of 1964). (42 U.S.C. 2809(a)(1)).

The cancellation rate is 15% of the original principal loan amount plus interest on the unpaid balance for each year of qualifying service. A "full-time staff member" is defined as a person regularly employed in a full-time capacity to carry out the educational part of a Head Start program. When applying for this type of cancellation, you may need to provide additional information. Click here to download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

If you are a Federal Perkins loan borrower, you may be eligible for up to 70% of your loan funds cancelled for service as a volunteer under the Peace Corps Act or the Domestic Volunteer Service Act of 1973 (ACTION programs). Borrowers of National Direct and National Defense loans are also eligible to cancel 70% of their loan amount if the service was performed on or after October 7, 1998.

The cancellation rate is 15% of the original principal loan amount plus interest for the first and second year of qualifying service, and 20% for the third and fourth year. The period of service in all cases must equal a 12-month period. (Your form must be certified by an authorized official of the Peace Corps or Americorps*VISTA program.)

Americorps volunteers do not qualify for this loan cancellation unless their volunteer service is with Americorps*VISTA. As an Americorps*VISTA volunteer, you may only qualify for this cancellation type if you do not elect to receive a national service education award for your volunteer service. In this case, you must provide appropriate documentation showing that you declined the Americorps national service education award.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Borrowers with a Defense loan made after April 13, 1970 for service starting after June 30, 1970 may be eligible to cancel up to 50% of these funds for full-time service in the US Army, Navy, Air Force, Marine Corps, or Coast Guard. The cancellation rate is 12% for each year of qualifying service. Service for less than a complete year does not qualify for military cancellation.

Federal Perkins and Direct borrowers may be eligible to cancel up to 50% of their loan for service performed in an area of hostilities that qualifies for special pay under section 310 of title 37 of the United States Code. The cancellation rate is 12 ½ % for each year of qualifying service that ended before August 14, 2008. Borrowers whose service includes August 14, 2008 or begins after that date may qualify to have up to 100% of their loan cancelled for this same service. The cancellation rate in this case is 15% of the original principal loan amount for the first and second year of service, 20% for the third and fourth year, and 30% for the fifth year of eligible service.

Service for less than a complete year does not qualify for military cancellation. Eligible branches of service include the US Army, Navy, Air Force, Marine Corps, or Coast Guard. For an up-to-date list of areas that qualify for special pay because of duty subject to hostile fire or imminent danger (areas of hostilities), visit: www.defenselink.mil/comptroller/fmr/07a/07aarch/07A10m.pdf.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Regardless of when you received your loan funds, you may be eligible to have up to 100% of your National Defense/National Direct/Federal Perkins loans canceled if you are employed as a full-time faculty member at a Tribal college or university. A full-time faculty member is defined as an educator or tenured individual who is employed by a Tribal college or university to teach, research, or perform administrative functions. The Department of Education provides a list of eligible Tribal colleges and universities. To determine if your school qualifies, click here.

Cancellation may be granted for eligible service that includes August 14, 2008, or begins after that date. To receive cancellation benefits as a faculty member at a Tribal college or university, you must be employed full time for 12 consecutive months.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

If you received Federal Perkins, National Direct, or National Defense loan funds, you may be eligible for up to 100% of your loan funds cancelled for service as a full-time staff member of a pre-kindergarten or childcare program that is licensed or regulated by the State.

Loan cancellation may be granted for eligible service that includes August 14, 2008, or begins after that date. To receive cancellation benefits as a full-time staff member of a pre-kindergarten or childcare program, you must be employed full time for 12 consecutive months. Also, when applying for this type of cancellation, you may need to provide additional information. Click here to download an Official Certification Letter for Cancellation Benefits. This form should be completed by your employer and accompany your properly completed Request for Cancellation.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

Regardless of when you received your loan funds, you may eligible to have up to 100% of their National Defense/National Direct/Federal Perkins loans canceled if you are a teacher in a designated low-income elementary or secondary school and are employed by an educational service agency. An educational service agency is a regional public multi-service agency authorized by State law to develop, manage, and provide services or programs to local educational agencies. The educational service agency must also be included in the directory of low-income schools. To determine if your educational service agency is listed, click here.

Cancellation may be granted for eligible service that includes August 14, 2008, or begins after that date. To receive cancellation benefits as a teacher in a low-income educational service agency, you must be employed full time for 12 consecutive months.

To apply for this cancellation type, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

To apply for a cancellation, download the required form(s) listed under Cancellation Information's Perkins Loan Program section Cancellation Types and Eligibility Requirements. Complete the form in detail and be sure to include any required authorization or documentation. Send the form to Campus Partners for processing. We will process your request promptly. You will receive notification explaining whether your cancellation request was applied, rejected, or returned to you for additional information.

Please mail your forms and other required information to:

Campus Partners

P.O. Box 2901

Winston-Salem, NC 27102

You may fax your forms to:

(336) 607-2093

If you have any questions regarding loan deferment or cancellation, please call us at (800) 334-8609.

You may have received a loan for education-related expenses directly from your school. These loans are often referred to as institutional loans. Because your school has loaned money to you, it can set the terms and conditions for the loan. Some schools allow their borrowers to apply for loan cancellation, but others do not. Since each institutional loan program is different, please consult the Terms and Conditions of your promissory note or contact us at (800) 334-8609 to determine what benefits (if any) are allowed.

You may be eligible for a Dental Residency deferment only for an internship or residency program in dentistry.

To apply for a Dental Residency deferment, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

You may be eligible for an Economic Hardship deferment if you have NO outstanding loans made before July 1, 1993, and meet one of

the following conditions:

NOTE: NDSL and Perkins Loans made before July 1, 1993 are now eligible for Economic Hardship deferment for periods commencing

October 7, 1998. Maximum length: three years. You must reapply every 12 months.

To apply for an Economic Hardship deferment, you must complete an Application for Hardship/Unemployment Deferment form, and submit this form to the school where you received the loan(s) or to its billing agent, Campus Partners.

To apply for forbearance, you must complete an Application for Forbearance form, and submit this form to the school where you received the loan(s) or to its billing agent, Campus Partners.

You may be eligible for a Grace deferment if you returned to school at least half-time before the expiration of your initial grace period.

The number of additional grace months depends on the original grace period. Refer to the table below:

| Date Money was Borrowed | Type of Loan Program | Grace Period Length |

|---|---|---|

| September 2, 1958 | National Defense Student Loan | 9-month grace period |

| July 1, 1972 | National Direct Student Loan | Effective October 1, 1980 - 6-month grace period* |

| July 1, 1987 | Perkins Student Loan | 9-month grace period |

*The lending institution has the option to delay this 6-month grace period to July 1, 1981.

To apply for a Grace deferment, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

You may be eligible for a Graduate Fellowship deferment if you are enrolled in a course of study that is part of an approved graduate fellowship program, or engaged in graduate or post-graduate fellowship-supported study (such as a Fulbright grant) outside the United States.

NOTE: NDSL and Perkins Loans made prior to July 1, 1993 are now eligible for Fellowship deferment for periods commencing October 7, 1998.

To apply for a Graduate Fellowship deferment, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

In addition, you must have your Graduate Fellowship Director complete and certify this Graduate Fellowship Deferment Certification letter and attach it to the deferment request form.

You may be eligible for an Internship/Residency deferment if you hold at least a baccalaureate or professional degree and serve in an internship program, provided the following criteria are met:

statement from the state-licensing agency indicating the internship is a pre-requisite for professional service.

A statement verifying your acceptance into the program and the anticipated dates of when you will begin and complete the program.

Your employer (usually a director) must certify your request form.

To apply for a Intership/Residency deferment, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

In addition, you must have an authorized official complete and certify this Internship/Residency Deferment Certification letter and attach it to the deferment request form.

You may be eligible for a Military deferment if you are or have been on full-time active duty "during a war or other military operation." Military operation is a "contingency operation" that:

A) Is designated by the Secretary of Defense as an operation in which members of the armed forces are or may become involved in military actions, operations, or hostilities against an enemy of the United States or against an opposing military force or

B) Results in the call or order to or retention on active duty of members of the uniformed services under section 688, 12301(a), 12302, 12304, 12305, 12406, of this title, chapter 15 of this title, or any other provision of law during a war or during a national emergency declared by the President or Congress [Title 10, Section 101(a)(13)].

Examples include:

If you file for deferment in either of the above areas, you would qualify for a military deferment/military cancellation.

Other contingency operations include:

If you meet either of the above criteria for your Perkins Loan, send a copy of your military orders or a written statement from your commanding officer or personnel officer, along with your completed deferment or cancellation form, to the school where you received the loan(s) or to its billing agent, Campus Partners. This documentation must state that you are serving on active duty or performing qualifying National Guard duty during a war or other military operation or national emergency.

If you are serving on active duty in the military but do not meet the criteria stated above, you may qualify for forbearance. Send a copy of your military orders or a written statement from your commanding officer or personnel officer that states you are serving on active duty, along with your completed deferment or cancellation form, to the school where you received the loan(s) or to its billing agent, Campus Partners.

To apply for a Millitary deferment, To apply for a Military deferment, you should complete a deferment request form, and submit this form along with supporting documentation to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form to Campus Partners, mail this form Request for Cancellation Form (CampusPartners) instead.

You may be eligible for a NOAA deferment if you are on full-time active duty in the National Oceanic and Atmospheric Administration Corps.

To apply for a NOAA deferment, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

In addition, you must have your Commanding Officer complete and certify this NOAA Deferment Certification letter and attach it to the deferment request form.

You may be eligible for a Parental Leave deferment if you are pregnant, caring for a newborn or newly adopted child and unable to attend an eligible school or be gainfully employed.

To qualify, you must be unemployed, not attending school and must apply for the deferment within six months of leaving school or dropping below half-time status.

To apply for a Parental Leave deferment, you must complete a cancellation request form and submit this form Request For Cancellation Form (Schools) to the school where you received the loan(s) or to its billing agent, Campus Partners. If submitting a form directly to Campus Partners, complete this form Request for Cancellation Form (CampusPartners) instead.

In addition, you must have your physician complete and certify this Parental Leave Deferment Certification letter and attach it to the deferment request form. A birth certificate or a statement from your physician stating the probable date of conception and birth date through postpartum care may serve as verification.

You may be eligible for this deferment if you are a Peace Corps, Vista or ACTION volunteer.